Investing towards your goals is not just about putting money aside; it's about having a clear plan and staying committed to achieving those financial milestones. Systematic Investment Plans (SIPs) are an excellent tool for disciplined investing that can help you realize your dreams, whether it's buying a home, funding your child's education, or planning for retirement.

Understanding SIPs

A SIP is a method of investing a fixed sum regularly in mutual funds, typically monthly. It allows you to enter the market without timing it and benefit from rupee cost averaging. This means you buy more units when prices are low and fewer when prices are high, potentially lowering your average cost per unit over time.

Setting SMART Goals

The key to successful financial planning with SIPs lies in setting SMART goals:

- Specific: Define exactly what you want to achieve. For example, "Save ₹30 lakhs for a down payment on a house."

- Measurable: Quantify your goal with a specific amount and timeframe. "Save ₹30 lakhs in 7 years."

- Achievable: Ensure your goal is realistic within your financial means.

- Relevant: Align your goal with your broader financial objectives.

- Time-bound: Set a clear deadline to create urgency and focus.

How SIPs Help Achieve Goals

- Discipline and Regularity: SIPs instill financial discipline by automating investments, helping you stay committed to your goals irrespective of market fluctuations.

- Rupee Cost Averaging: By investing a fixed amount regularly, you buy more units when prices are low and fewer when prices are high, smoothing out market volatility.

- Power of Compounding: Starting early and staying invested allows your investments to grow exponentially over time due to compounding returns.

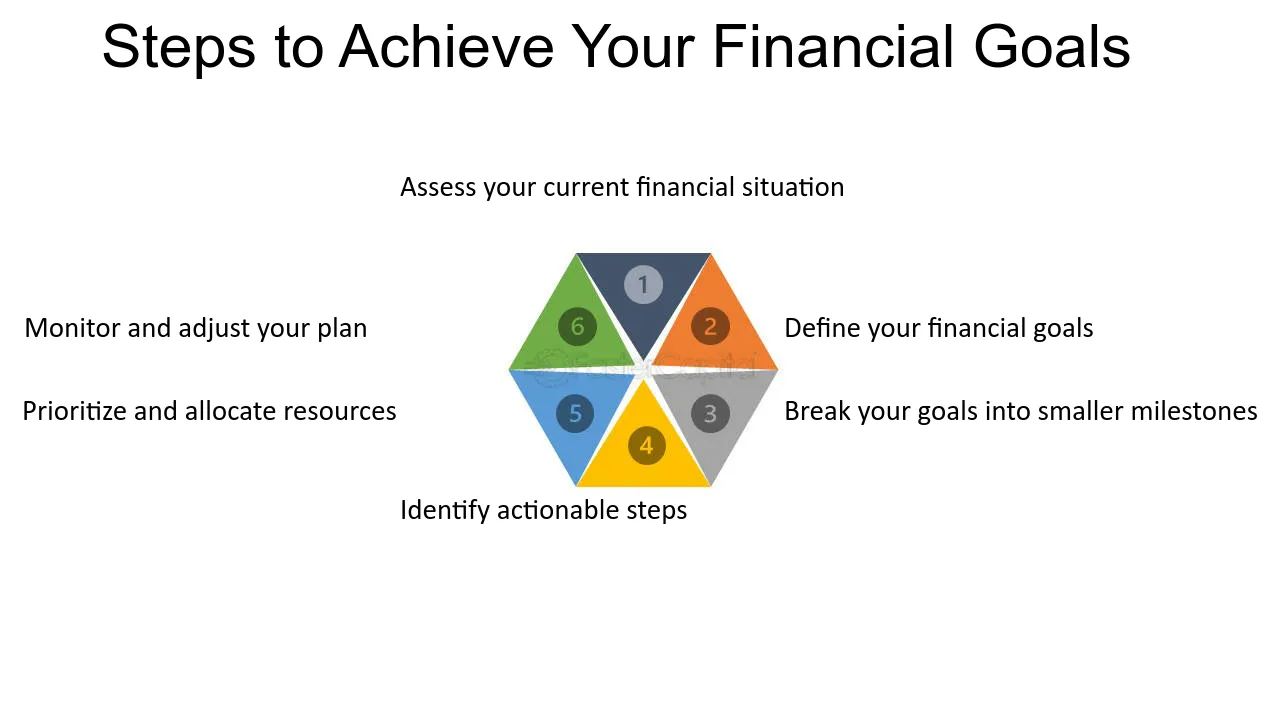

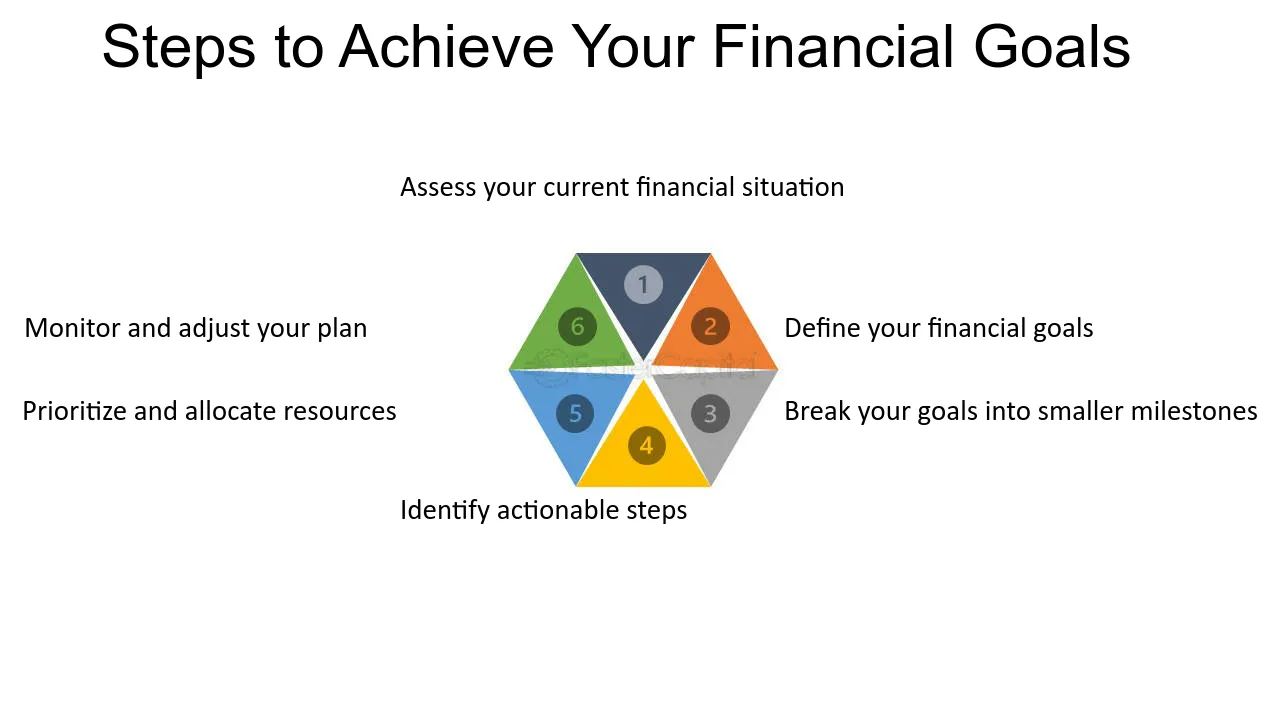

Steps to Implement SIPs Effectively

- Identify Your Goals: List down your short-term, medium-term, and long-term financial goals.

- Choose Suitable SIPs: Select mutual funds that align with your risk appetite and investment horizon. Use tools like the SIP Calculator to estimate potential returns based on different scenarios.

- Set Up SIPs: Open a mutual fund account and start your SIPs based on your investment plan.

- Monitor and Adjust: Regularly review your investments to ensure they are on track to meet your goals. Use tools like the SWP Calculator and FD Calculator to optimize your financial strategy as needed.

Tracking Your Progress

- Review Periodically: Check your investment performance periodically against your goals. Adjust your SIP amount if necessary to stay on track.

- Celebrate Milestones: Celebrate small victories along the way to stay motivated.

- Stay Informed: Keep yourself updated with market trends and economic developments that could impact your investments.

Conclusion

Investing through SIPs is a powerful strategy to achieve your financial goals methodically. By setting clear goals, choosing the right investment vehicles, and staying disciplined, you can pave the way towards a secure financial future. Start today and watch your dreams become reality one SIP at a time.

For more information and to explore our financial calculators, visit EzyCalculators to plan your financial journey with confidence.